Repayment cover

Having a repayment cover on your pension means that your family (husband, wife, cohabiter, and children) continue to receive your pension payments in the event of your death. It also means that your own pension will be lower. You can add or remove repayment cover. If you do not make an active choice, your insurance will not include repayment cover.

You can add or remove repayment cover

You add or remove your repayment cover by filling out our form.

Remove repayment cover (pdf, new browser)

Add repayment cover (pdf, new browser)

Health declaration (pdf, new browser)

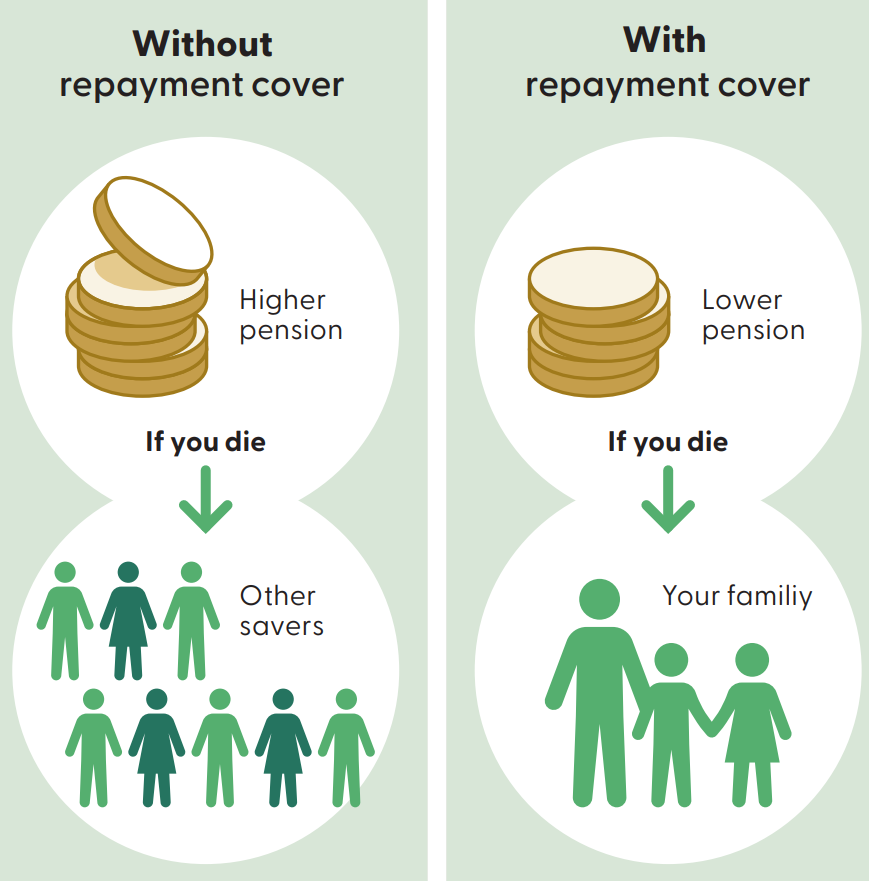

Insurance with or without repayment cover

If you choose no repayment cover, your pension will be higher. This is because you get a share of money from other savers who died and did not have repayment cover.

Repayment cover means that if you die, we pay out the money to your family. If you choose repayment cover, your pension will be lower. This is because you do not get a share of money from other savers who have died.

Questions and answers

What does repayment cover cost?

If you choose repayment cover your pension will be lower. This is because by choosing repayment cover you do not receive part of the inheritance gain. The inheritance gain is the pension capital remaining in insurances without repayment cover following the death of the insured person and which is shared among all other insurances that do not have repayment cover.

The cost of repayment cover is not exact since it depends on future returns and the actual lifetime of insured persons in the society. The table shows some examples of what repayment cover is expected to cost in terms of a lower pension from different ages. The figures are based on you having repayment cover from start and continue to be a government employee until the age of 65.

| You are | Payment in 5 years | Payment for life |

|---|---|---|

| 25 years old | -5 % | -24 % |

| 55 years old | -3 % | -22 % |

When you can add or remove repayment cover?

You can remove your repayment cover at any time. If you have not started withdrawing your pension, you have the option to add repayment cover:

- within six months of the insurance starting

- within a year from getting married, cohabiting or having children

- if you are in good health with an approved health check

- to future premiums in a new insurance.

Who receives to the survivor's pension?

According to Kåpan’s general beneficiary clause, the survivors’ pension is paid primarily to your spouse, registered partner or cohabitant and secondly to your children. In a specific beneficiary clause you can change the order or distribution and to a certain extent who will receive the survivors’ pension.

You can choose the following persons as beneficiaries:

- spouse, registered partner or cohabitant

- former spouse, registered partner or cohabitant

- children, foster children of yours or any of the above persons.

Parents and siblings can never be beneficiaries.

For how long is the survivor's pensions paid out?

The survivor's pensions is normally paid out for five years after your death.

For how long is the repayment cover valid?

If you have opted for a limited period for pension withdrawal, the repayment cover remains valid until you receive your final payment. If your pension is paid out for the duration of your lifetime, the repayment cover is valid until the month of your 90th birthday. If you started lifetime payments before January 1, 2025, your repayment cover is valid until the month of your 75th birthday.

What other protection do you have as a government employee?

When you are a government employee, your family is entitled to a survivor's pension and occupational group life insurance if you die. You can read more about how much is paid out and who can take part in the money at The National Government Employee Pensions Board's webbsite.